Illegal Trade & Its Impact On Economy

DID YOU KNOW?

Rs. 77 BILLION IS LOOTED FROM PAKISTAN EVERY YEAR[1]

The looting is in lieu of ‘Illicit Trade of Cigarettes’ [2]

But what exactly is ‘Illicit Cigarette Trade’?

Tobacco products produced locally but under-declared to evade taxes

Legally produced tobacco products that are smuggled into an illegal market

Tobacco products manufactured without the permission of trademark rights holder

Why should you be concerned?

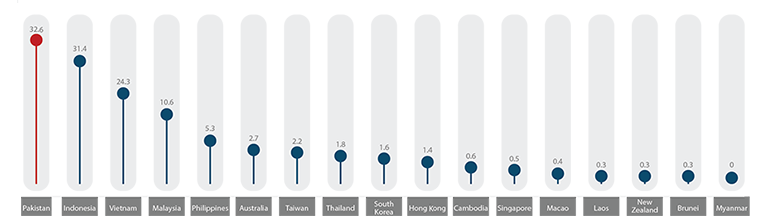

Because Pakistan is #1 in illicit cigarette consumption across 16 countries in Asia and Australasia.

Illicit Cigarette Consumption in Asia for 2017 (Billion of Sticks)

Source: Oxford Economics - Asia Illicit Tobacco Indicator

PM Imran Khan on Illicit Trade of Cigarettes

“Only two tobacco companies, with a market share of around 60% contribute 98% of the tobacco tax collection, whereas all other tobacco companies operating illegally contribute only 2% to the national exchequer despite having a market share of about 40%.”

- Prime Minister Imran Khan’s speech on his ‘First 100 days in Government’

What can you do?

Simply put if you’re a legal-aged cigarette smoker, don’t buy illicit cigarettes.

Here’s how you can identify them:

No Graphical Health

Warning on the cigarette pack

Minimum government mandated

price of a cigarette pack is Rs. 63,

whereas average selling price of a

local illicit cigarette pack is Rs. 20-35 [5]

Spread the word!

#AwazUthaoMulkBachao #44Billion4Pakistan

stopillegaltrade.pk

Sources:

- Oxford Economics - Asia Illicit Tobacco Indicator 2017: Average tax revenue loss from FY12/13 - FY18/19

- Asia Illicit Tobacco Indicator 2017: Pakistan

- The Citizens Foundation cost of sponsoring one student’s education

- Saylani Welfare Trust cost of feeding one meal

- Sale of illicit cigarettes: PM wants countrywide crackdown - Business Recorder, 24th September, 2019

Share with your friends

Do note, we do not promote cigarette smoking, tobacco products or tobacco use –

the document serves the purpose of detailing how illicit trade in the cigarette sector impacts the national exchequer

Stop Illicit Cigarette Trade

and save Rs. 44 Billion annually

Petition to Policy Makers and Government of Pakistan

I will not stay silent

I will not let the illicit cigarette mafia rob my country

I will work with others to campaign against this menace

I will speak out against illicit cigarette mafia

I will not stop until they are stopped

Stop Illicit Cigarette Trade

and save Rs. 44 Billion annually

Petition to Policy Makers and Government of Pakistan

I will not stay silent

I will not let the illicit cigarette mafia rob my country

I will work with others to campaign against this menace

I will speak out against illicit cigarette mafia

I will not stop until they are stopped

In Pakistan, Rs. 44 Billion is looted every year by illicit cigarette trade [1]. This robbery is done by illicit cigarette manufacturers who under-declare their production to evade taxes.

In 2018, Oxford Economics published a report, wherein, a survey was conducted across 16 countries in Asia, Pakistan ranked number 1 for illegal Cigarette Consumption [2]. Off the 77.8 Billion cigarette sticks consumed in Pakistan, 41.9% of that market is captured by illegal cigarettes which account for 32.6 Billion non-tax paid cigarettes [2]. If we are able to collect this amount, it will help bring in new revenue streams which can be invested in Pakistan to improve public services, provide employment opportunities and have a direct impact on our national growth.

There is an urgent need to #StopIllegalTrade of all forms to ensure our country prospers.

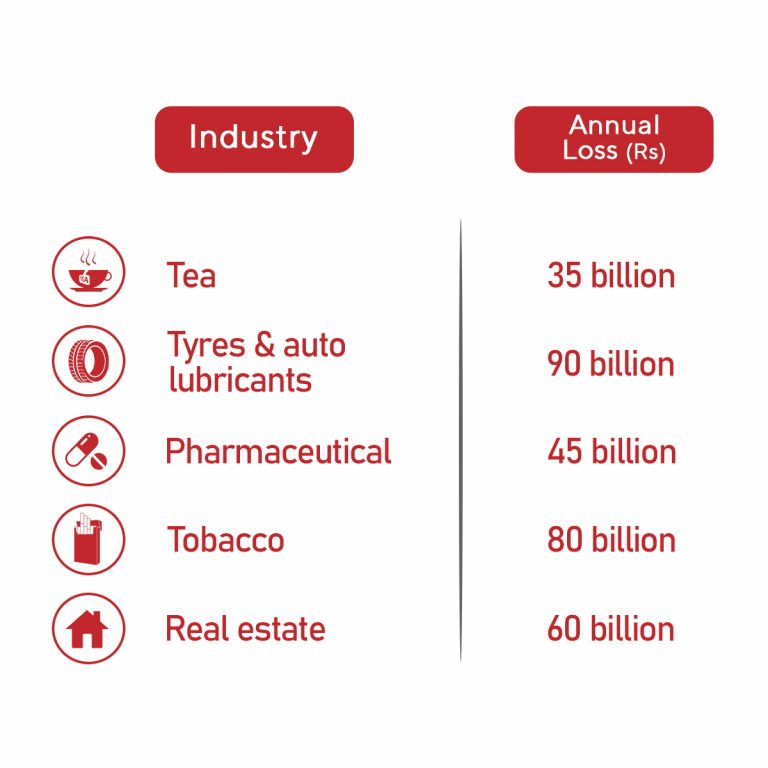

Overview

Pakistan is plagued by illegal trade across major sectors, this is negatively affecting tax revenue, causing difficulties in growth and dissuading investment opportunities [3]. It is estimated that

Pakistan loses Rs. 300 Billion every year due to smuggling in just 11 goods

(this does not include counterfeit, tax evasion and under declaration by local manufacturers)[4]

The significance of this issue is such that Prime Minister Imran Khan made a mention of illegal trade and smuggling taking place across industries in his ‘First 100 days in Government’ speech and the harm it brings to Pakistan’s economy.

Our next big challenge should be the detection and elimination of illegal and illicit trade in our country that has been ravaging our economy every single day. When we talk about the unfair trade of goods in Pakistan, issues that come under light are: Illegal Wildlife trade, illegal trade of goods like mobile phones, televisions, vehicles, fabrics, auto parts, diesel, tea and trade of tobacco and many others.

A study by the customs department revealed alarming statistics on illegal trade in Pakistan. It is estimated that 59% of the overall demand of the products that includes petroleum, tea, mobile phones and auto parts industry, is met through illegal and unfair trade practices of smuggled goods [3]. This development is an explanation and core reason as to why Pakistan continues to suffer from low tax revenue and a difficult growth path.

Overview:

It estimated that in the fiscal year 2014, 59% of the total demand for products of over half a dozen sectors of the formal economy, including petroleum, tea, mobile phones and auto parts industry, is was met through illicit trade of smuggled goods.

It was reported, from 2014 to 2018, the volume of goods smuggled into Pakistan increased nearly threefold. In terms of value as a share of Pakistan’s gross domestic product (GDP), smuggling went up from 3.88% to 11.25% in that period.

Rs310b annual tax evasion by five sectors [3]